2025 Year in Review: Gold Shines, Stocks Deliver, Bitcoin Stumbles

In this special year-end issue, I review the highs and lows of 2025, from the 'tariff tantrum' to the crypto crash. I’ll also detail how the strategy protected capital during drawdowns and explain my latest shift into Emerging Markets heading into 2026.

At a Glance

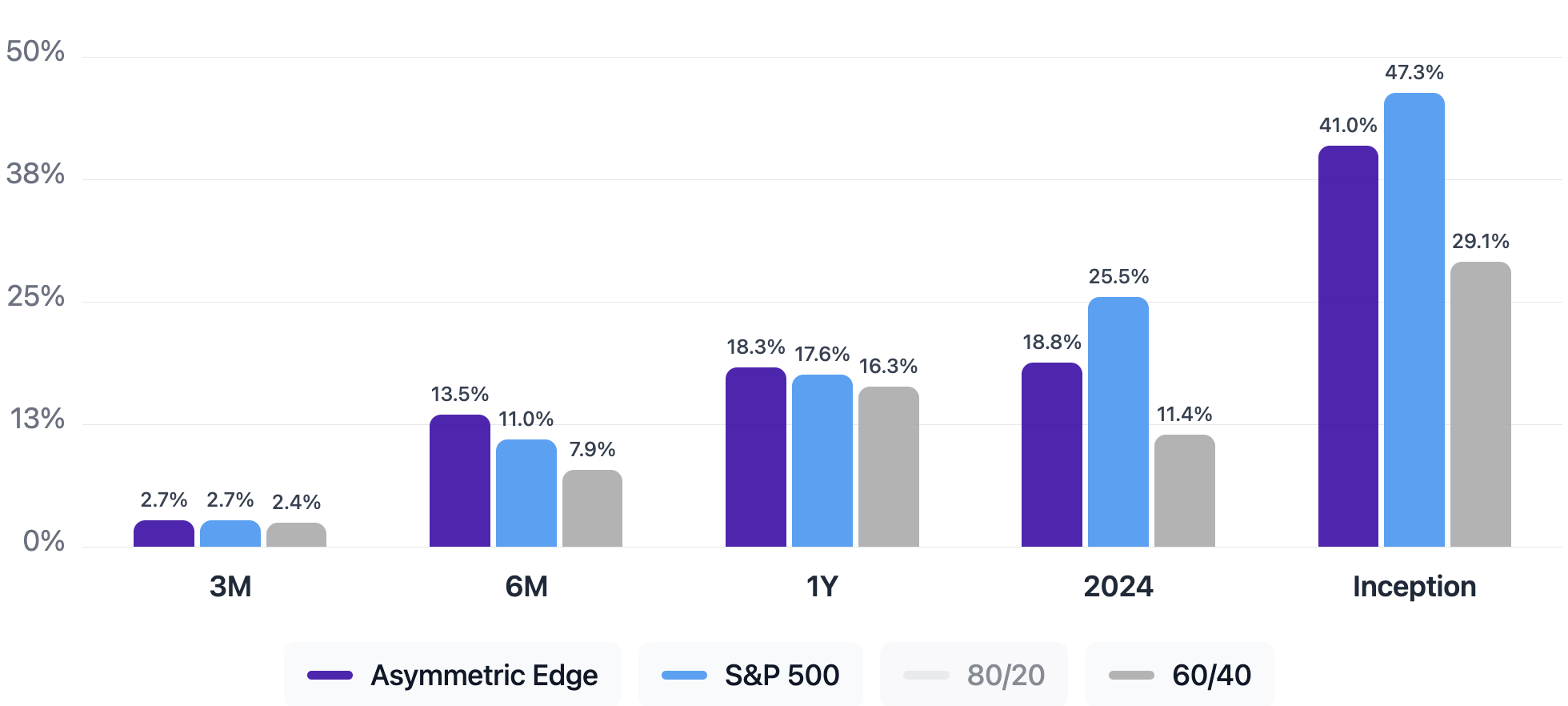

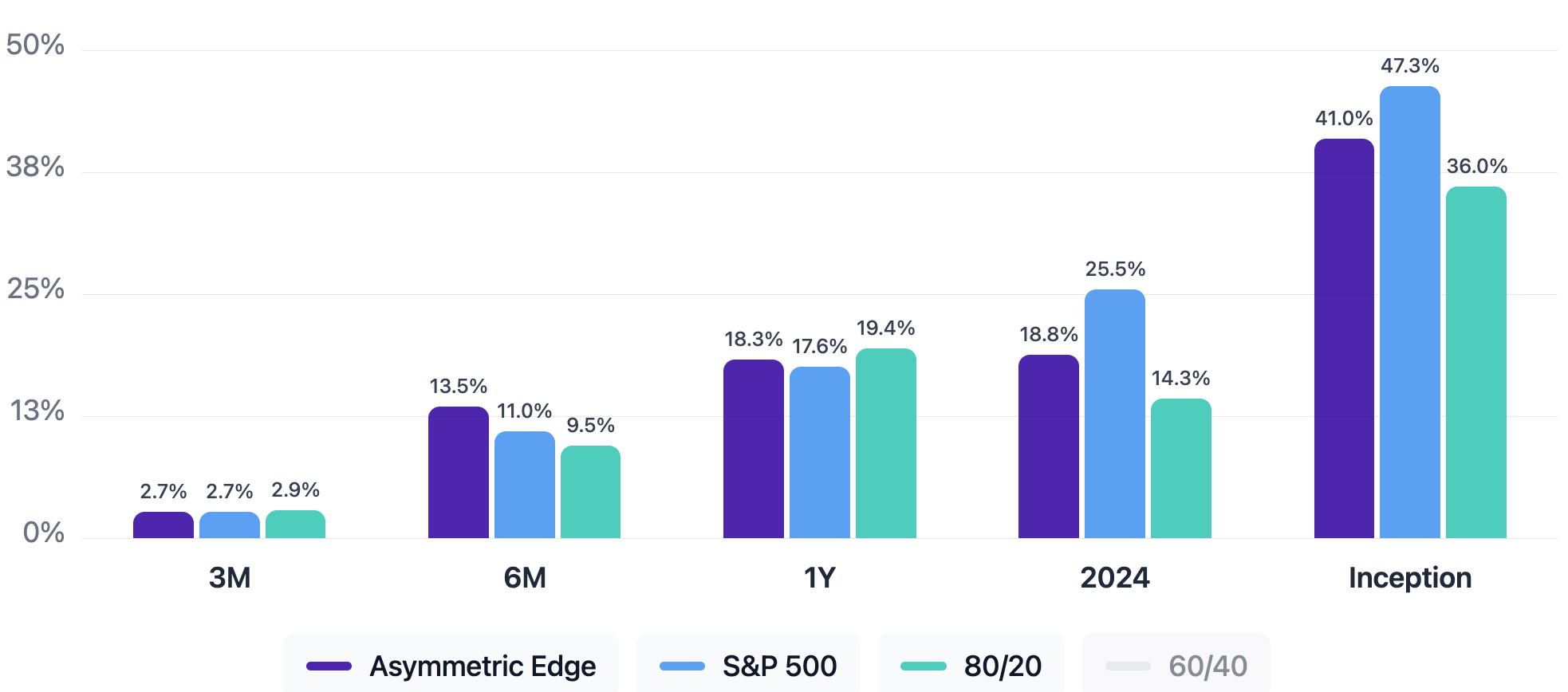

The Asymmetric Edge strategy returned 18.3% in 2025, beating the S&P 500's 17.6% return. This marks the first calendar year where the strategy outperformed the benchmark while also beating 60/40 and keeping pace with 80/20 portfolios, all with significantly lower drawdowns.

In this special year-end issue, I review the highs and lows of 2025, from the 'tariff tantrum' to the crypto crash. I’ll also detail how the strategy protected capital during drawdowns and explain my latest shift into Emerging Markets heading into 2026.

📌 This newsletter explains how I invest my own money, using a simple portfolio of four ETFs. I share what I hold and why, so readers can see one real world approach in action.

Market Movement Summary

- 🚀 Asymmetric Edge outperforms the S&P 500 for the first full calendar year

- 🧈 Gold posted its best year since 1979, surging nearly 64%

- 🇺🇸 U.S. stocks notched a third consecutive year of double-digit gains

- 🔻 Bitcoin disappointed despite early optimism, ending down over 7%

- 🛍️ April's tariff-driven selloff proved to be the buying opportunity of the year

Portfolio Shifts

- Bitcoin exited the portfolio as momentum deteriorated

- Emerging markets ex-China entered via EMXC

- Gold remains the largest holding heading into 2026

Theme of the Year

2025 will be remembered as the year gold (and precious metals more broadly) reasserted itself as a key portfolio component. The metal rose approximately 64%, while silver more than doubled with gains exceeding 140%. Both posted their strongest performance since 1979. Central bank buying, geopolitical tensions, Fed rate cuts, and a weakening dollar created a perfect storm for the so-called "debasement trade."

One Number That Matters

The S&P 500 posted its third consecutive year of double-digit gains, which is something that has happened only six times since the 1940s. The index rose 17.6% in 2025, following 26% in 2024, and 25% in 2023.

Market Moves

Portfolio & Benchmark Returns

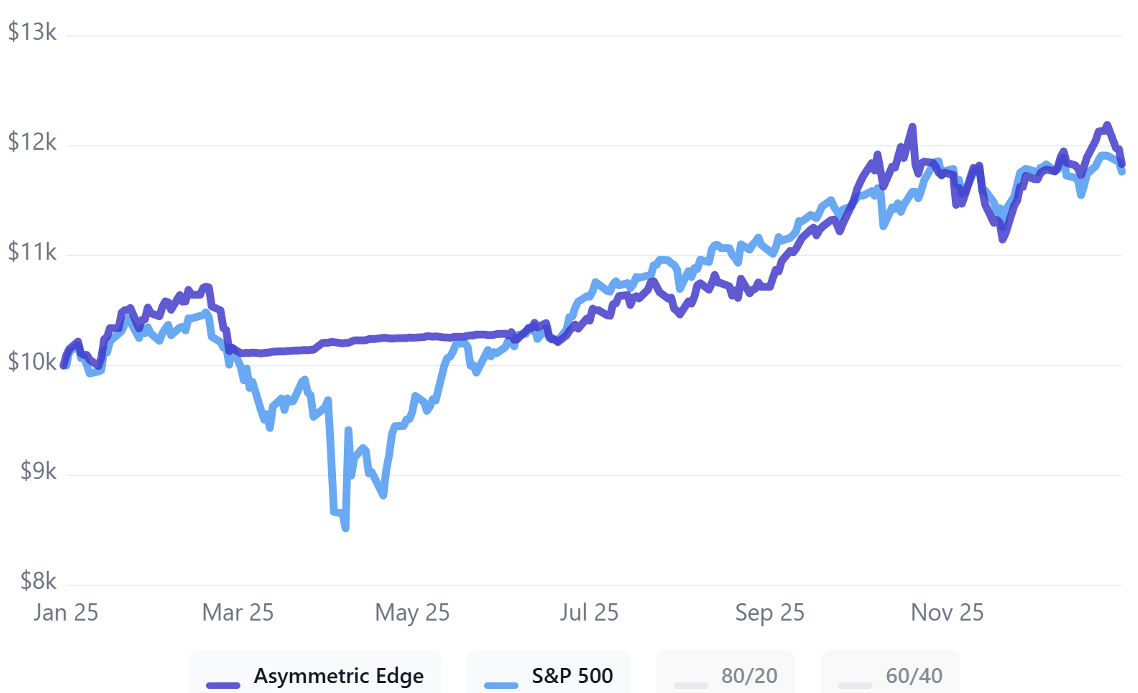

The chart above shows how the strategy has held up over time versus a traditional 60/40 portfolio (60% stocks, 40% bonds). While the S&P 500 leads since inception (January 2, 2024), my approach has delivered near-market returns with a smoother ride along the way.

The Asymmetric Edge strategy delivered 18.3% for the year, edging out the S&P 500's 17.6% return. While an 80/20 portfolio (80% stocks, 20% bonds) led in 2025 at 19.4%, my strategy continues to outperform traditional balanced portfolios since inception while maintaining significantly lower drawdowns.

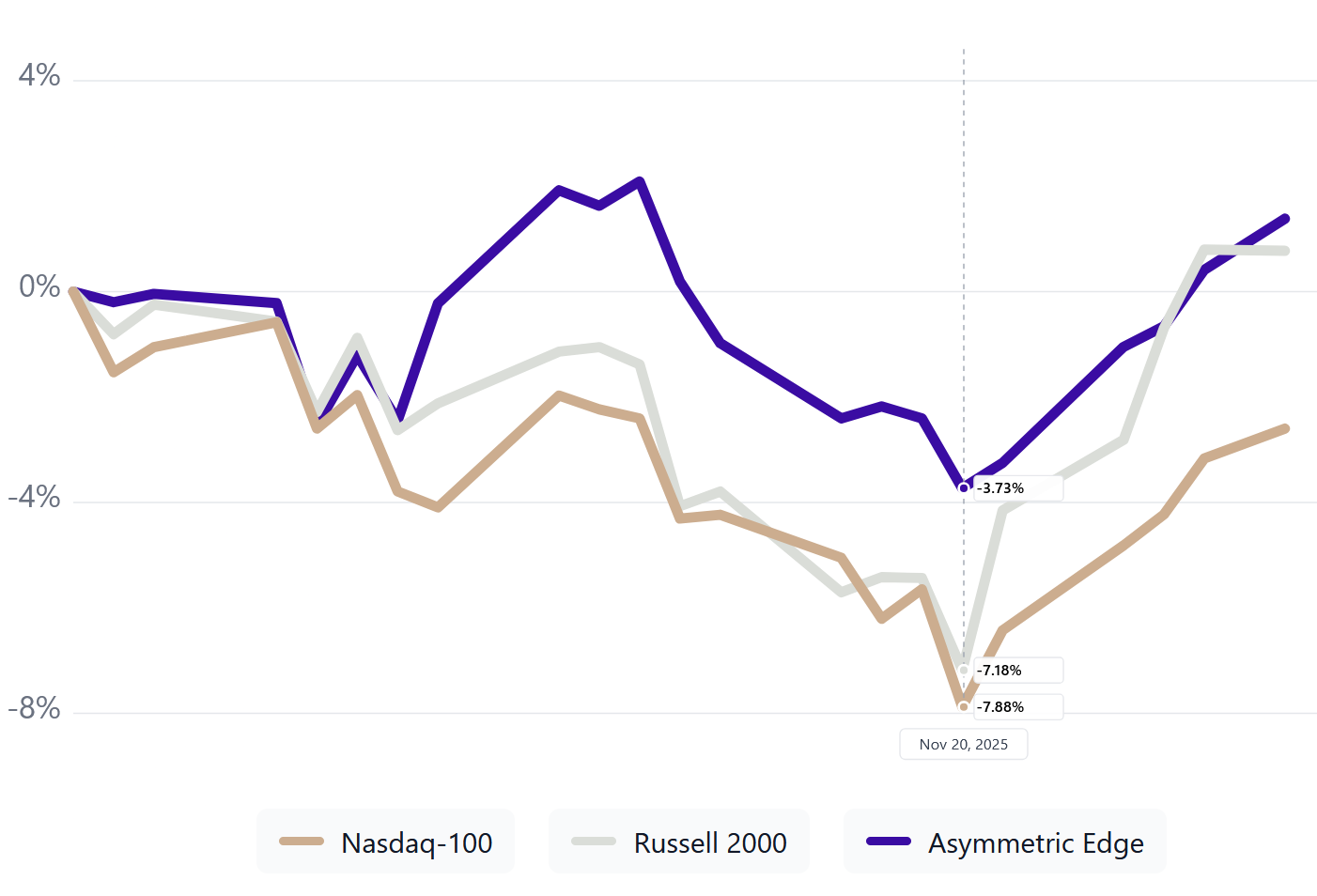

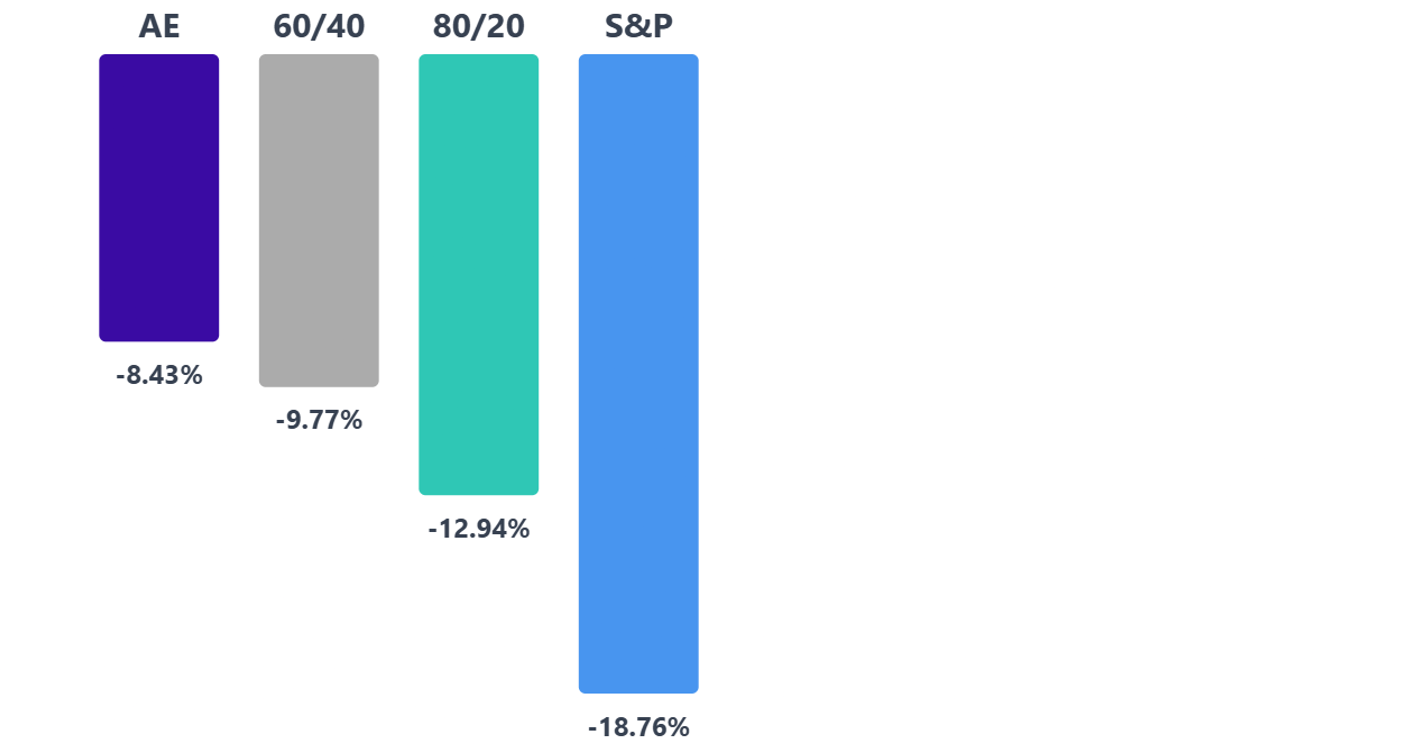

Shallower Drawdowns

When markets sold off in November, the strategy held up significantly better than the Nasdaq-100 and Russell 2000. The chart above illustrates how the portfolio's diversification cushioned the blow.

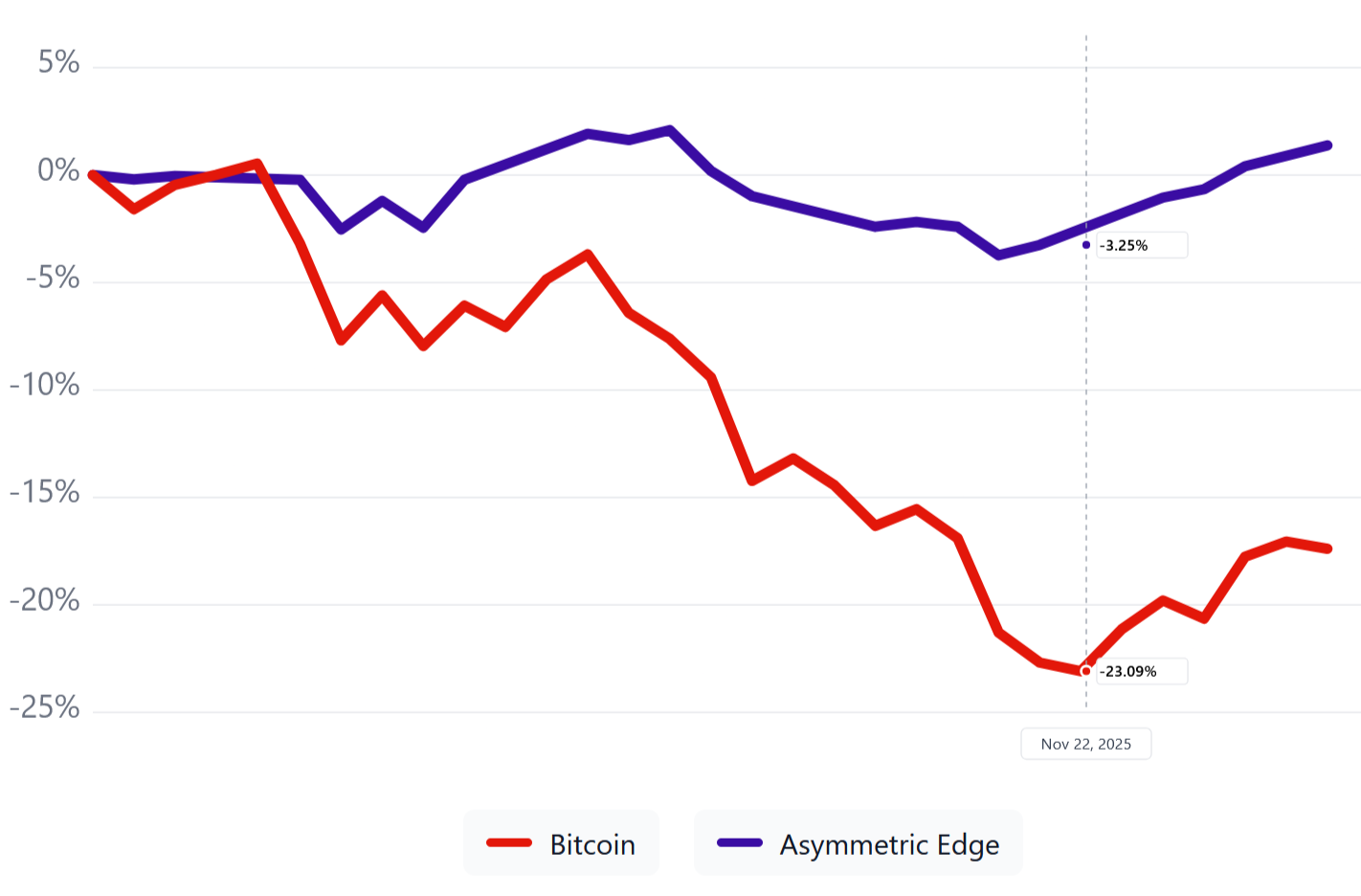

Weathering a Major Bitcoin Decline

A core feature of this portfolio is the ability to take meaningful positions in volatile asset classes with asymmetric upside potential while managing the downside when those bets do not play out as hoped. Bitcoin's November decline was a case study.

The selloff began in October but accelerated sharply in November, with bitcoin dropping around 23% in just two weeks. At the start of the month, 13.5% of the portfolio sat in bitcoin, which was a substantial position. Yet the strategy finished November down only 0.24%. The lesson: big bets on uncorrelated assets, sized by their risk contribution, can hold up well even when one individual asset takes a hit.

2025: A Year of Extremes

Markets began the year on an optimistic note as President Trump returned to office and AI enthusiasm continued to drive markets higher. Then came so-called "Liberation Day" on April 2nd, when broader-than-expected tariffs sent the S&P 500 plunging nearly 19% from its February highs, the biggest market drop since the pandemic.

Asymmetric Edge's momentum-based approach helped navigate this turbulence. As relative strength shifted during the selloff, the portfolio reduced exposure to risk assets when momentum deteriorated and added back when strength returned after tariffs were paused in June. By late June, U.S. stocks had recovered to new record highs in what became the quickest recovery from a 15%+ decline in S&P 500 history.

Charting the Growth of $10,000

Since Inception in January 2024

The chart above shows how a representative $10,000 investment would have grown in four portfolios since January 2024: the S&P 500, Asymmetric Edge, a 60/40 portfolio, and an 80/20 portfolio.

2025 Performance vs S&P 500

The portfolio has not sidestepped every downturn, but the path has been relatively smooth while largely keeping pace with the S&P 500 over the past two years. Traditional 60/40 and 80/20 portfolios lagged significantly.

Asymmetric Edge vs Primary Benchmarks

This chart shows the strategy's performance from January 2024 through December 2025 against 60/40 and 80/20 portfolios, which are more relevant benchmarks than the S&P 500 for a balanced, multi-asset approach.

Outperformance with Less Pain

2025 Max Drawdowns

This is perhaps the result I'm proudest of: how cleanly the strategy sidestepped drawdowns during 2025. Asymmetric Edge posted the lowest maximum drawdown over the course of the year, measured as the worst peak-to-trough decline (which was from October 20th through November 20th). Everyone has a different risk tolerance, but I know I have an easier time staying the course when my portfolio holds up well when markets take a hit.

Broader Asset Class Returns

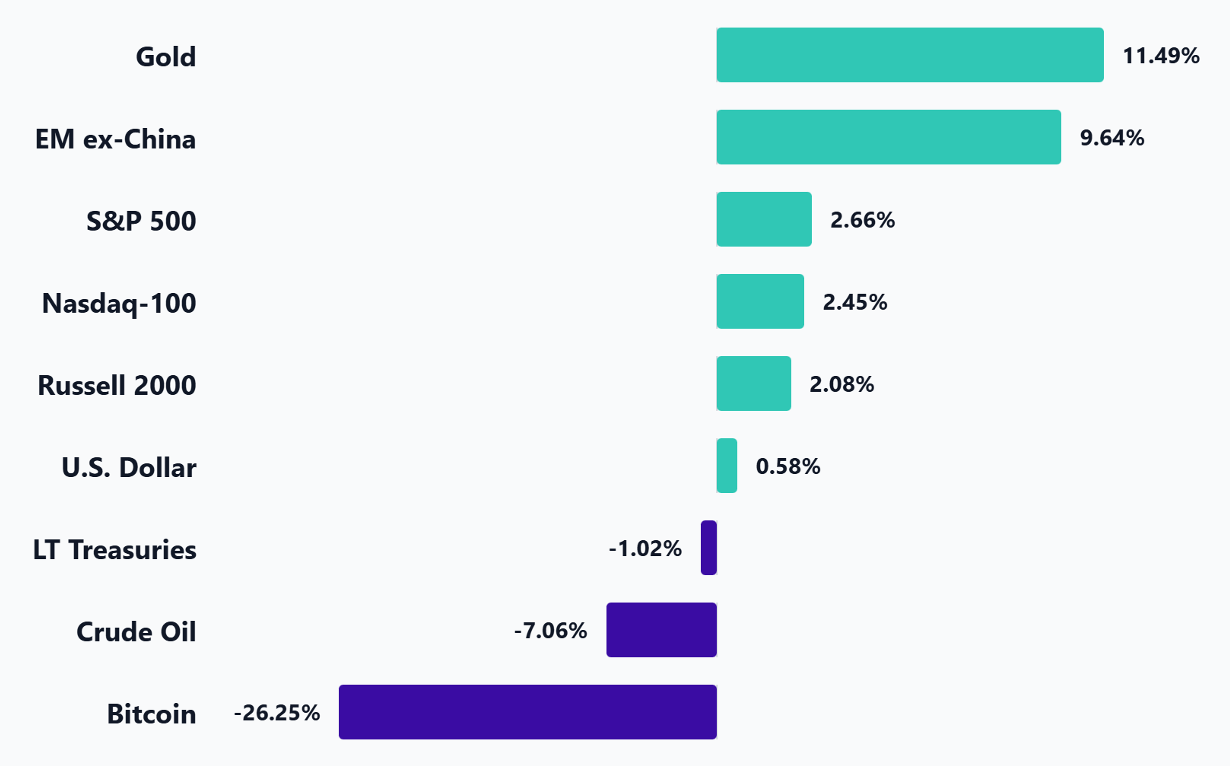

Trailing 3 Month Returns

The fourth quarter told a story of divergence. Gold continued its march higher, gaining over 11% in the final three months while bitcoin collapsed by more than 26%. This stark contrast drove the decision to remove bitcoin from the portfolio as its relative strength deteriorated. Emerging markets ex-China emerged as a standout, benefiting from dollar weakness and the broadening global recovery.

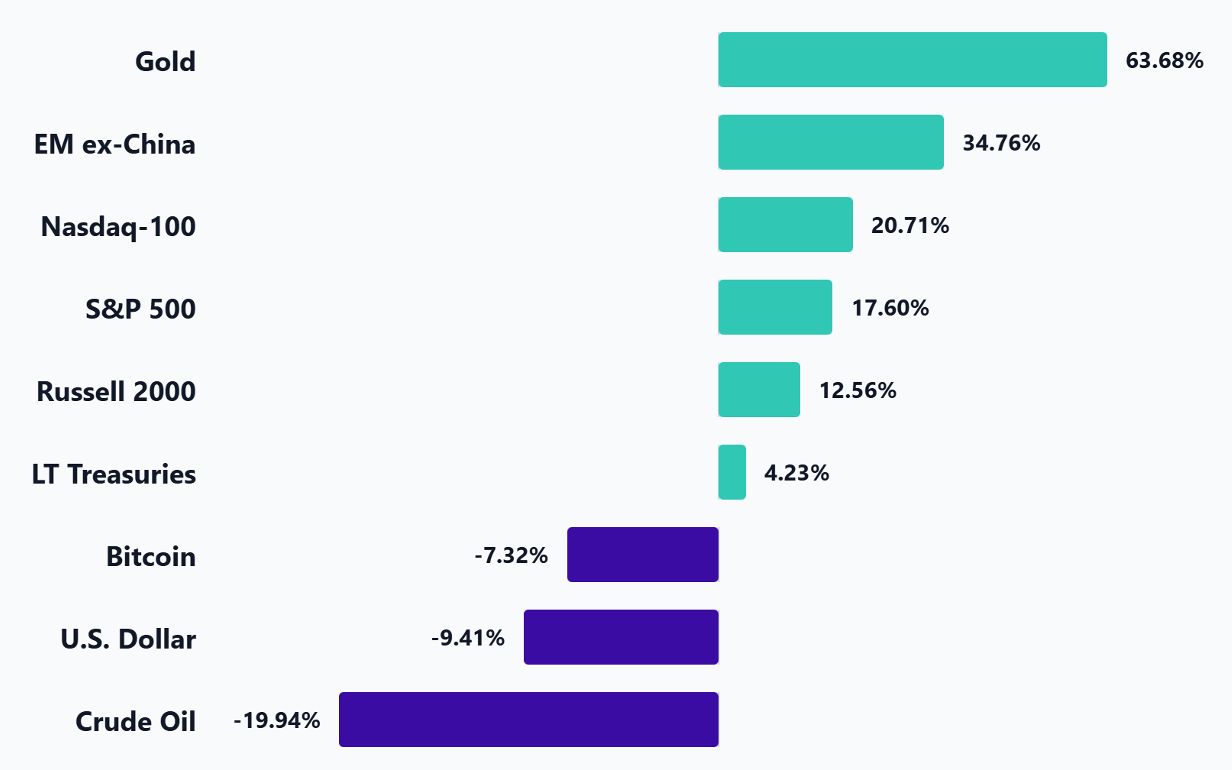

Full Year 2025 Returns

Gold's dominance in 2025 cannot be overstated. The yellow metal more than tripled the S&P 500's return for the year, vindicating the strategy's allocation to alternative assets beyond just stocks and bonds. With roughly 40% of the portfolio in gold during the strongest months of its rally, this position was the primary driver of outperformance.

Meanwhile, bitcoin proved to be the year's biggest disappointment. Despite hitting a record high above $126,000 in early October amid crypto-friendly policies from the Trump administration, the cryptocurrency tumbled into a bear market and ended the year down over 7%.

The U.S. dollar posted its worst year since 2017, falling 9.4%, and creating a major tailwind for commodities and international assets priced in dollars.

The Highs and Lows of 2025

📈 The Highs

- Gold surges 64%: The best annual gain since 1979, driven by central bank buying, geopolitical uncertainty, and Fed rate cuts

- Silver more than doubles: Gained over 140% as industrial demand from solar and EVs combined with investment flows

- S&P 500 makes it three in a row: Third consecutive year of double-digit gains, a rare achievement

- Fastest recovery ever: Markets rebounded from April lows to new highs in just 89 days

- International breakout: South Korea's Kospi surged 76%, Spain gained 49%, Poland rose 47%, and the broad international index (MSCI ACWI ex-USA) returned 30%, its widest margin of outperformance versus the S&P 500 since 2009

📉 The Lows

- Bitcoin stumbles: Despite hitting $126,000, ended the year down over 7% after entering a bear market

- April tariff tantrum: "Liberation Day" wiped out months of gains in days

- Dollar weakness: The dollar index fell 9.4%, its worst year since 2017

- Oil slides: Crude fell nearly 20% despite geopolitical tensions

- Volatility spikes: The VIX touched levels not seen since the pandemic during the April selloff

Portfolio Shifts

My Portfolio Allocations for January 2026

| Asset | Ticker | Weight | Purpose |

|---|---|---|---|

| 🟨 Gold | GLD | 34.45% | Inflation & crisis hedge |

| 🌏 EM ex-China | EMXC | 25.28% | Emerging markets diversification without China concentration risk |

| 🔷 Russell 2000 | IWM | 20.57% | Small-cap US exposure |

| 💻 Nasdaq | QQQ | 19.70% | Growth from US tech leaders |

Deep Dive: Out with Europe, In with Emerging Markets ex-China

One of the most significant changes to the strategy's ETF universe this month is swapping out EZU (iShares MSCI Eurozone ETF) for EMXC (iShares MSCI Emerging Markets ex China ETF). This is not just a momentum-driven rotation. It reflects a fundamental reassessment of what each position actually adds to the portfolio.

Why EZU Had to Go

I believe EZU served a purpose when the dollar was weakening and European equities were outperforming in early 2025. But on closer analysis, the position was not delivering the diversification benefits it appeared to offer.

Two problems stood out:

Hidden China exposure. Germany's economy, particularly luxury goods, autos, and industrials, is heavily dependent on Chinese consumption. By holding EZU, I was effectively taking China's economic and geopolitical risk without exposure to China's growth sectors. In my view, this presented all the downside with little of the upside.

Fading momentum. After a strong start to the year, Eurozone stocks lost steam in Q4. The relative strength ranking reflected this deterioration.

Why EMXC Makes Sense Now

EMXC offers something genuinely different: broad emerging market exposure with zero direct China allocation.

🌏 EMXC tracks the MSCI Emerging Markets ex China Index, capturing companies across 22 emerging markets while completely excluding Chinese equities. Top countries include Taiwan (~29%), India (~21%), and South Korea (~19%).

Here's what EMXC brings:

The "friend-shoring" theme. As corporations reduce reliance on Chinese supply chains, manufacturing flows to India, Mexico, Vietnam, and Indonesia. EMXC captures this structural shift.

Genuine diversification. The correlation between China and EM ex-China has fallen to its lowest level in over 20 years. China's regulatory crackdowns and property stress do not drag down EMXC the way they would a broad emerging markets fund.

Dollar weakness tailwind. Emerging markets historically outperform when the dollar weakens. With the dollar index falling 9.4% in 2025, EMXC is positioned to benefit if this trend continues.

Strong momentum. EMXC returned 34.76% for the year, significantly outpacing the S&P 500's 17.6%. Contrary to popular belief, strong trends tend to persist.

2025's Key Lessons

Lesson 1: The Value of Diversification Beyond Stocks

This year demonstrated powerfully why I invest across multiple asset classes rather than just U.S. stocks and bonds. Gold delivered nearly 4x the return of the S&P 500. Silver more than doubled. International stocks outperformed. If your portfolio was concentrated in just the S&P 500, you left significant returns on the table.

The Asymmetric Edge strategy rotates among 9+ ETFs spanning U.S. and international equities, bonds, commodities, and alternatives. This breadth ensures I am positioned to capture returns wherever they emerge, whether that's gold in 2025, bitcoin in 2024, or tech stocks in 2023.

Lesson 2: Volatility Creates Opportunity

April's selloff felt terrifying in real-time. The S&P 500 dropped 18.9% from its February highs. Headlines screamed about trade wars and recession risks. Many investors panicked and sold.

But that selloff became the buying opportunity of the year. Markets recovered to new highs within 89 days, the fastest recovery from a 15%+ decline ever recorded. Investors who maintained their discipline were rewarded handsomely.

This is why systematic, rules-based investing matters. When emotions run high, having a tested strategy that tells you what to do based on data, not fear, is invaluable.

Lesson 3: Stay Flexible About Individual Holdings

The portfolio held bitcoin for much of 2025. It hit all-time highs in October. The thesis seemed sound. But when momentum reversed and relative strength deteriorated, the strategy signaled to exit. No attachment to the asset, no hoping it would bounce back. Just following the process.

This flexibility is a feature, not a bug. The strategy does not need bitcoin or any single asset to succeed. It needs to own whatever is showing the strongest momentum among its universe of options.

Wrap Up

2025 was a year that rewarded discipline and diversification. Those who stayed invested through April's chaos were rewarded with the fastest recovery in market history. Those who owned gold participated in its best year since the 1970s. Those who maintained a systematic approach avoided the emotional whipsaws that trip up so many investors.

The Asymmetric Edge strategy delivered 18.3% for the year while outperforming the S&P 500, 60/40, and keeping pace with 80/20 portfolios, all with significantly lower maximum drawdowns. Since inception in January 2024, the strategy has returned 41.0%.

As we enter 2026, the portfolio is positioned with significant gold exposure, emerging market diversification, and balanced U.S. equity holdings through Nasdaq and Russell 2000 ETFs. The strategy will continue adapting as relative strength evolves. That is what I designed it to do.

Thank you for joining me in my first year writing this newsletter. I look forward to many prosperous years to come!

Disclaimer & Disclosure

This newsletter is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer to sell or buy any securities. The content is published as a journal of the author's personal investment activities and is intended for a general audience.

No Investment Advice: The author is not a financial advisor. You should not treat any opinion expressed herein as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of opinion.

Risk Warning: Investment involves risk, including the possible loss of principal. Past performance is not indicative of future results. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment.

Data & Accuracy: Information contained herein has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. All expressions of opinion are subject to change without notice in reaction to shifting market conditions.

Positions: The author currently holds positions in the securities mentioned in this newsletter. The author may buy or sell these securities at any time without notice.

Copyright: This content is provided solely for the personal use of the subscriber. Any unauthorized copying, forwarding, or distribution of this material is prohibited without prior written consent.